| Documentation: | Canadian Census 2011 |

you are here:

choose a survey

survey

document

chapter

Publisher: Statistics Canada

Survey: Canadian Census 2011

| Document: | Statistics Canada - Catalogue no. 99-000-X2011001 National Household Survey |

| citation: | Social Explorer; Statistics Canada - Catalogue no. 99-000-X2011001 National Household Survey |

Chapter Contents

Statistics Canada - Catalogue no. 99-000-X2011001 National Household Survey

For economic family members, this refers to economic family after-tax income that has been adjusted by a factor that accounts for family size. The adjustment factor takes into account the lower relative needs of additional family members, as compared to a single person living alone, and is determined by using a scale that assigns a lower value to additional family members. The adjusted after-tax family income is then computed by dividing the family's after-tax income by the factor. Multiple equivalence scales are used in published data. The one chosen for use with the NHS income data is simply the square root of family size.

For persons not in economic families, the adjusted after-tax income is set at after-tax income. This is equivalent to a factor of 1.0 for a person not in an economic family.

For persons not in economic families, the adjusted after-tax income is set at after-tax income. This is equivalent to a factor of 1.0 for a person not in an economic family.

Reported in: 2011

Reported for: Population in private households, economic families and persons not in economic families

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of total income, see 'Remarks' under Total income. See also After-tax income, Economic family and Economic family status.

A similar variable existed in the 2006 Census but was based on a different equivalence scale.

Reported for: Population in private households, economic families and persons not in economic families

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of total income, see 'Remarks' under Total income. See also After-tax income, Economic family and Economic family status.

A similar variable existed in the 2006 Census but was based on a different equivalence scale.

After-tax income of a household divided by the square root of household size.

Adjusted after-tax income of households refers to the after-tax income of a household that has been adjusted by a factor that accounts for household size. The adjustment factor takes into account the lower relative needs of additional household members, as compared to a person living alone, and is determined by using a scale that assigns a lower value to additional household members. The adjusted after-tax income of households is then computed by dividing the household's after-tax income by the factor. Multiple equivalence scales are used in published data. The one chosen for use with the NHS income data is simply the square root of household size.

Reported in: 2011

Reported for: Private households and population in private households.

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of total income, see 'Remarks' under Total income.

See also After-tax income, Household, private and Household size.

This variable is used to help compute the Low-income measure after-tax (LIM-AT).

Reported for: Private households and population in private households.

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of total income, see 'Remarks' under Total income.

See also After-tax income, Household, private and Household size.

This variable is used to help compute the Low-income measure after-tax (LIM-AT).

For economic family members, this refers to economic family income that has been adjusted by a factor that accounts for family size. The adjustment factor takes into account the lower relative needs of additional family members, as compared to a single person living alone, and is determined by using a scale that assigns a decreasing value to the second and subsequent family members. The adjusted family income is then computed by dividing the family's income by the factor. Multiple equivalence scales are used in published data. The one chosen for use with the NHS income data is simply the square root of family size.

For persons not in economic families, the adjusted income is set at total income. This is equivalent to a factor of 1.0 for a person not in an economic family.

For persons not in economic families, the adjusted income is set at total income. This is equivalent to a factor of 1.0 for a person not in an economic family.

Reported in: 2011

Reported for: Population in private households, economic families and persons not in economic families

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of total income, see 'Remarks' under Total income. For details on the economic family and economic family status of individuals, see Economic family and Economic family status.

A similar variable existed in the 2006 Census but was based on a different equivalence scale.

Reported for: Population in private households, economic families and persons not in economic families

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of total income, see 'Remarks' under Total income. For details on the economic family and economic family status of individuals, see Economic family and Economic family status.

A similar variable existed in the 2006 Census but was based on a different equivalence scale.

Sum of the market income of household members divided by the square root of household size.

Adjusted market income of households refers to the sum of market income of all members of the household that has been adjusted by a factor that accounts for household size. The adjustment factor takes into account the lower relative needs of additional household members, as compared to a person living alone, and is determined by using a scale that assigns a lower value to additional household members. The adjusted market income of households is thus computed by dividing the sum of market income of household members by the factor. Multiple equivalence scales are used in published data. The one chosen for use with the NHS income data is simply the square root of household size.

Reported in: 2011

Reported for: Private households and population in private households

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of market income, see Market income.

See also Household, private and Household size.

This variable is used to help compute the Low-income measure of market income (LIM-MI).

Reported for: Private households and population in private households

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of market income, see Market income.

See also Household, private and Household size.

This variable is used to help compute the Low-income measure of market income (LIM-MI).

Adjusted total income of households refers to the household total income that has been adjusted by a factor that accounts for household size. The adjustment factor takes into account the lower relative needs of additional household members, as compared to a person living alone, and is determined by using a scale that assigns a lower value to additional household members. The adjusted total income of households is thus computed by dividing the household total income by the factor. Multiple equivalence scales are used in published data. The one chosen for use with the NHS income data is simply the square root of household size.

Reported in: 2011

Reported for: Private households and population in private households

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of total income, see 'Remarks' under Total income.

See also Household, private and Household size.

This variable is used to help compute the Low-income measure before-tax (LIM-BT).

Reported for: Private households and population in private households

Question no.: Derived variable

Responses: Not applicable

Remarks: For details on the components of total income, see 'Remarks' under Total income.

See also Household, private and Household size.

This variable is used to help compute the Low-income measure before-tax (LIM-BT).

Refers to total income from all sources minus federal, provincial and territorial income taxes paid for 2010.

Refers to total income minus federal, provincial and territorial income taxes paid for calendar year 2010. Total income refers to income from all sources, including employment income, income from government programs, pension income, investment income and any other money income. Federal, provincial and territorial taxes paid refer to taxes on income, after taking into account exemptions, deductions, non-refundable tax credits and the Quebec abatement. These taxes are obtained from the income tax files for persons who allowed access to their income tax data and from direct responses on the questionnaire for others.

The after-tax income of a census family is the sum of the after-tax incomes of all members of that family.

Reported in: 2011

Reported for: Census families in private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income and on the reference period, coverage and methodology for income data, see 'Remarks' under Total income. See also After-tax income and Census family.

Reported for: Census families in private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income and on the reference period, coverage and methodology for income data, see 'Remarks' under Total income. See also After-tax income and Census family.

The after-tax income of an economic family is the sum of the after-tax incomes of all members of that family.

Reported in: 2011

Reported for: Economic families in private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income and on the reference period, coverage and methodology for income data, see 'Remarks' under Total income. See also After-tax income and Economic family.

Reported for: Economic families in private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income and on the reference period, coverage and methodology for income data, see 'Remarks' under Total income. See also After-tax income and Economic family.

The after-tax income of a household is the sum of the after-tax incomes of all members of that household.

Reported in: 2011

Reported for: Private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income and on the reference period, coverage and methodology for income data, see 'Remarks' under Total income. See also After-tax income and Household, private.

Reported for: Private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income and on the reference period, coverage and methodology for income data, see 'Remarks' under Total income. See also After-tax income and Household, private.

Average income of families (census or economic) or persons aged 15 years and over not in families refers to the sum of total incomes of these families or persons in 2010 divided by the number of units.

Average income of households refers to the sum of total incomes in 2010 of households divided by the total number of households.

Average income of individuals refers to the dollar amount obtained by adding up the total income of all individuals aged 15 years and over who reported income for 2010 and dividing this sum by the number of individuals with income.

Refers to benefits received during calendar year 2010 from the Canada Pension Plan or Quebec Pension Plan (for example, retirement pensions, survivors' benefits and disability pensions). Does not include lump-sum death benefits.

Refers to total Employment Insurance benefits received during calendar year 2010, before income tax deductions. It includes benefits for unemployment, sickness, maternity, parental, adoption, compassionate care and benefits to self-employed fishers received under the federal Employment Insurance program or the Québec Parental Insurance Plan.

Reported in: 2011

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Questions 54 and 55(g)

Responses: Dollar value or nil

Remarks: See also 'Remarks' under Total income.

The amount to be repaid based on net income when filing a tax return is excluded.

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Questions 54 and 55(g)

Responses: Dollar value or nil

Remarks: See also 'Remarks' under Total income.

The amount to be repaid based on net income when filing a tax return is excluded.

Census family total income is the sum of the total incomes of all members of that family.

Reported in: 2011

Reported for: Census families in private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income, see 'Remarks' under Total income.

See also Census family.

Reported for: Census families in private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income, see 'Remarks' under Total income.

See also Census family.

Refers to payments received under the Canada Child Tax Benefit program during calendar year 2010 by parents with dependent children under 18 years of age. Included with the Canada Child Tax Benefit is the National Child Benefit Supplement (NCBS) for low-income families with children. The NCBS is the federal contribution to the National Child Benefit (NCB), a joint initiative of federal, provincial and territorial governments. Also included in this variable are child benefits, child disability benefits and earned income supplements provided by certain provinces and territories and the Universal Child Care Benefit (UCCB).

Payments made in 2010 for child care arrangements which allowed the responsible person(s) to earn

employment income.

Refers to all payments made over the period of 2010 for non-parental child care arrangements which allowed the responsible person(s) to earn employment income. Included in these expenses are babysitters, daycares, day camps, live-in caregivers or any arrangement in which money was exchanged for child care services. Excluded are child care payments made for purposes unrelated to earning employment income, such as entertainment or personal needs.

Reported in: 2011

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Question 52

Responses: Dollar value or nil

Remarks: Introduced in the 2011 NHS, child care expenses paid were collected to help compute the deductions required from after-tax income to obtain Disposable income for the MBM.

These amounts differ slightly from the related income tax deduction: the value is not capped based on the age of the children, any family member could report them.

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Question 52

Responses: Dollar value or nil

Remarks: Introduced in the 2011 NHS, child care expenses paid were collected to help compute the deductions required from after-tax income to obtain Disposable income for the MBM.

These amounts differ slightly from the related income tax deduction: the value is not capped based on the age of the children, any family member could report them.

Payments made in 2010 to a former spouse or partner for child and/or spousal support.

Child or spousal support payments paid in 2010 under an agreement to pay a fixed amount on a regular basis to a former spouse or partner, or for a child. This variable excludes all other gifts or transfers of money.

Reported in: 2011

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Question 53

Responses: Dollar value or nil

Remarks: Introduced in the 2011 NHS, child or spousal support payments were taken into account to help compute the deductions required from after-tax income to obtain Disposable income for the MBM.

Support payments received from a former spouse or partner would be considered income and included in Other money income.

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Question 53

Responses: Dollar value or nil

Remarks: Introduced in the 2011 NHS, child or spousal support payments were taken into account to help compute the deductions required from after-tax income to obtain Disposable income for the MBM.

Support payments received from a former spouse or partner would be considered income and included in Other money income.

The composition of the total income of a population group or a geographic area refers to the relative share of each income source or group of sources, expressed as a percentage of the aggregate total income of that group or area.

Reported in: 2011

Reported for: Population aged 15 years and over with income in private households

Question no.: Derived statistic

Responses: Not applicable

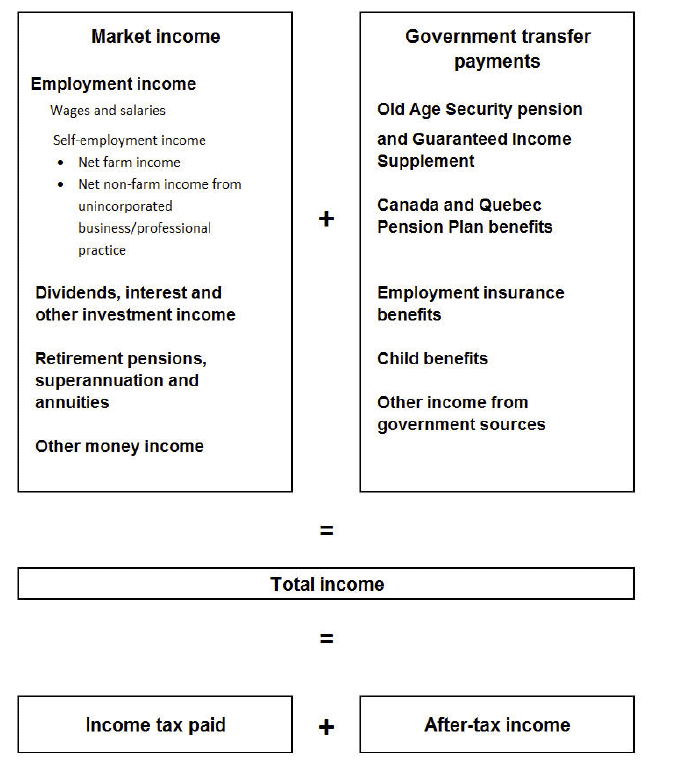

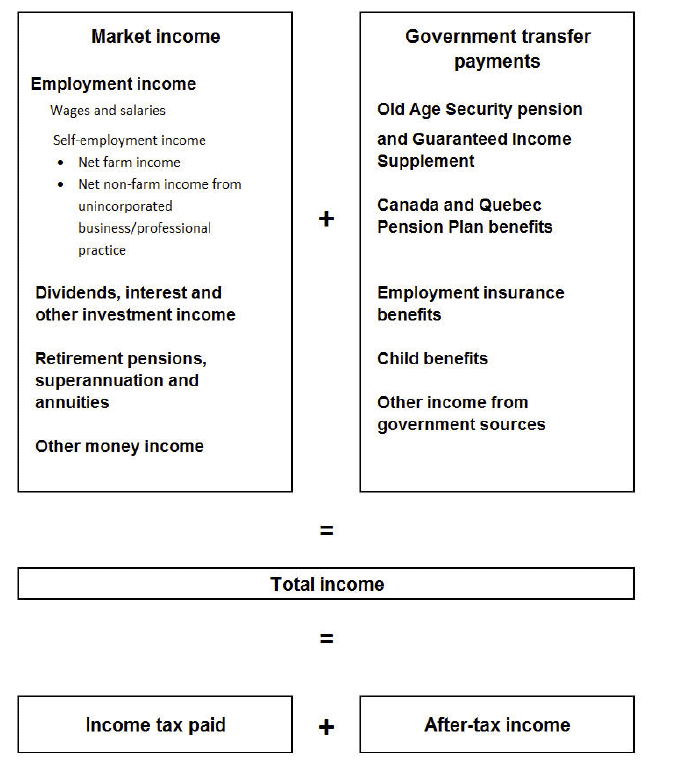

Remarks: The components of total income and the combinations for which percentages may be published are shown in Figure 3.1 Components of income in 2010.

Figure 3.1 Components of income in 2010

Source: Statistics Canada, Income Statistics Division.

Reported for: Population aged 15 years and over with income in private households

Question no.: Derived statistic

Responses: Not applicable

Remarks: The components of total income and the combinations for which percentages may be published are shown in Figure 3.1 Components of income in 2010.

Figure 3.1 Components of income in 2010

Source: Statistics Canada, Income Statistics Division.

Refers to the disposable income available to an economic family or a person not in an economic family as defined for the Human Resources and Skills Development Canada's (HRSDC) Market Basket Measure (MBM).

The disposable income for the MBM is an income concept developed by Human Resources and Skills Development Canada (HRSDC) for comparing against the Market Basket Measure (MBM) thresholds.

The disposable income for the MBM is the amount of income available to purchase goods and services. It is derived by deducting income taxes and non-discretionary spending for the MBM from total income.

For units in households that own a dwelling without a mortgage, the mortgage-free homeowner's advantage for the MBM is added to the disposable family income. This amount represents typical savings compared to rent or ownership with a mortgage.

The disposable income for the MBM is the amount of income available to purchase goods and services. It is derived by deducting income taxes and non-discretionary spending for the MBM from total income.

For units in households that own a dwelling without a mortgage, the mortgage-free homeowner's advantage for the MBM is added to the disposable family income. This amount represents typical savings compared to rent or ownership with a mortgage.

Reported in: 2011

Reported for: Economic families and persons not in economic families aged 15 years and over in private households

Question no.: Derived variable

Responses: Not applicable

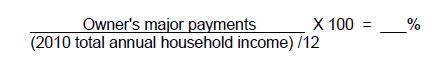

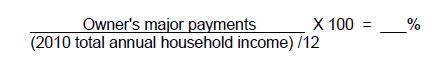

Remarks: Like the MBM thresholds, the mortgage-free homeowner's advantage for the MBM is defined for each of the 49 MBM geographies. These amounts are presented in Table 3.6 Mortgage-free homeowner's advantage for the Market Basket Measure (MBM), 2010.

For the LICO-AT and the LIM-AT, only income taxes paid are deducted from total family income before comparison to the associated low-income thresholds.

See also Non-discretionary spending for the MBM and Market Basket Measure (MBM).

For information on various low-income concepts and disposable income, see also Low income lines, 2011-2012, Income Research Paper Series (Catalogue no. 75F0002M - no. 002).

Table 3.6 Mortgage-free homeowner's advantage for the Market Basket Measure (MBM), 2010

Note: The geographic area concepts and the Market Basket Measure (MBM) thresholds were defined by Human Resources and Skills Development Canada (HRSDC). This amount corresponds to the cost of a specific basket of goods and services representing a modest, basic standard of living in each of the 49 MBM geographic regions.

1 To convert to other family sizes, multiply the amount for persons not in economic families by the square root of the desired family size.

Source: Statistics Canada, Income Statistics Division.

Reported for: Economic families and persons not in economic families aged 15 years and over in private households

Question no.: Derived variable

Responses: Not applicable

Remarks: Like the MBM thresholds, the mortgage-free homeowner's advantage for the MBM is defined for each of the 49 MBM geographies. These amounts are presented in Table 3.6 Mortgage-free homeowner's advantage for the Market Basket Measure (MBM), 2010.

For the LICO-AT and the LIM-AT, only income taxes paid are deducted from total family income before comparison to the associated low-income thresholds.

See also Non-discretionary spending for the MBM and Market Basket Measure (MBM).

For information on various low-income concepts and disposable income, see also Low income lines, 2011-2012, Income Research Paper Series (Catalogue no. 75F0002M - no. 002).

Table 3.6 Mortgage-free homeowner's advantage for the Market Basket Measure (MBM), 2010

| MBM region | Persons not in economic families | Economic family size1 | |||

| 2 persons | 3 persons | 4 persons | 5 persons | ||

| Newfoundland and Labrador | |||||

| Rural areas | 1,460 | 2,065 | 2,529 | 2,920 | 3,265 |

| Small population centres with less than 30,000 persons | 1,319 | 1,865 | 2,284 | 2,637 | 2,948 |

| St. John's (CMA) | 1,424 | 2,013 | 2,466 | 2,847 | 3,183 |

| Prince Edward Island | |||||

| Rural areas | 1,665 | 2,355 | 2,884 | 3,330 | 3,723 |

| Small population centres with less than 30,000 persons | 1,565 | 2,213 | 2,711 | 3,130 | 3,499 |

| Charlottetown (CA) | 1,807 | 2,555 | 3,129 | 3,613 | 4,039 |

| Nova Scotia | |||||

| Rural areas | 1,890 | 2,673 | 3,274 | 3,780 | 4,226 |

| Small population centres with less than 30,000 persons | 1,409 | 1,993 | 2,440 | 2,818 | 3,151 |

| Medium population centres with a population between 30,000 and 99,999 persons | 1,881 | 2,660 | 3,258 | 3,762 | 4,206 |

| Halifax (CMA) | 2,164 | 3,060 | 3,747 | 4,327 | 4,838 |

| Cape Breton (CA) | 1,441 | 2,038 | 2,496 | 2,882 | 3,222 |

| New Brunswick | |||||

| Rural areas | 1,570 | 2,220 | 2,719 | 3,140 | 3,511 |

| Small population centres with less than 30,000 persons | 1,406 | 1,988 | 2,435 | 2,812 | 3,144 |

| Medium population centres with a population between 30,000 and 99,999 persons | 1,316 | 1,860 | 2,279 | 2,631 | 2,942 |

| Fredericton (CA) | 2,495 | 3,528 | 4,321 | 4,989 | 5,578 |

| Saint John (CMA) | 1,391 | 1,966 | 2,408 | 2,781 | 3,109 |

| Moncton (CMA) | 1,895 | 2,679 | 3,281 | 3,789 | 4,236 |

| Quebec | |||||

| Rural areas | 1,223 | 1,730 | 2,118 | 2,446 | 2,735 |

| Small population centres with less than 30,000 persons | 945 | 1,336 | 1,636 | 1,889 | 2,112 |

| Medium population centres with a population between 30,000 and 99,999 persons | 1,197 | 1,692 | 2,072 | 2,393 | 2,675 |

| Large urban population centres with a population between 100,000 and 499,999 persons | 1,239 | 1,752 | 2,145 | 2,477 | 2,769 |

| Québec (CMA) | 1,443 | 2,041 | 2,499 | 2,886 | 3,227 |

| Montréal (CMA) | 1,376 | 1,945 | 2,382 | 2,751 | 3,076 |

| Ontario | |||||

| Rural areas | 1,917 | 2,710 | 3,319 | 3,833 | 4,285 |

| Small population centres with less than 30,000 persons | 1,617 | 2,287 | 2,801 | 3,234 | 3,616 |

| Medium population centres with a population between 30,000 and 99,999 persons | 1,750 | 2,475 | 3,031 | 3,500 | 3,913 |

| Large urban population centres with a population between 100,000 and 499,999 persons | 2,047 | 2,895 | 3,546 | 4,094 | 4,577 |

| Ottawa - Gatineau (Ontario part) (CMA) | 2,715 | 3,839 | 4,702 | 5,429 | 6,070 |

| Hamilton (CMA) | 1,930 | 2,729 | 3,342 | 3,859 | 4,314 |

| Toronto (CMA) | 2,871 | 4,060 | 4,973 | 5,742 | 6,420 |

| Manitoba | |||||

| Rural areas | 1,400 | 1,980 | 2,425 | 2,800 | 3,130 |

| Small population centres with less than 30,000 persons | 1,695 | 2,397 | 2,936 | 3,390 | 3,790 |

| Brandon (CA) | 1,851 | 2,618 | 3,206 | 3,702 | 4,139 |

| Winnipeg (CMA) | 1,959 | 2,770 | 3,393 | 3,918 | 4,380 |

| Saskatchewan | |||||

| Rural areas | 1,143 | 1,616 | 1,979 | 2,285 | 2,555 |

| Small population centres with less than 30,000 persons | 1,185 | 1,675 | 2,052 | 2,369 | 2,649 |

| Medium population centres with a population between 30,000 and 99,999 persons | 1,245 | 1,761 | 2,156 | 2,490 | 2,784 |

| Saskatoon (CMA) | 1,409 | 1,993 | 2,440 | 2,818 | 3,151 |

| Regina (CMA) | 1,413 | 1,998 | 2,447 | 2,826 | 3,160 |

| Alberta | |||||

| Rural areas | 2,149 | 3,038 | 3,721 | 4,297 | 4,804 |

| Small population centres with less than 30,000 persons | 2,373 | 3,356 | 4,110 | 4,746 | 5,306 |

| Medium population centres with a population between 30,000 and 99,999 persons | 2,881 | 4,074 | 4,989 | 5,761 | 6,441 |

| Edmonton (CMA) | 2,473 | 3,497 | 4,282 | 4,945 | 5,529 |

| Calgary (CMA) | 2,948 | 4,168 | 5,105 | 5,895 | 6,591 |

| British Columbia | |||||

| Rural areas | 2,818 | 3,985 | 4,880 | 5,635 | 6,300 |

| Small population centres with less than 30,000 persons | 2,487 | 3,516 | 4,307 | 4,973 | 5,560 |

| Medium population centres with a population between 30,000 and 99,999 persons | 2,784 | 3,936 | 4,821 | 5,567 | 6,224 |

| Large urban population centres with a population between 100,000 and 499,999 persons | 3,449 | 4,877 | 5,973 | 6,897 | 7,711 |

| Vancouver (CMA) | 3,520 | 4,978 | 6,097 | 7,040 | 7,871 |

Note: The geographic area concepts and the Market Basket Measure (MBM) thresholds were defined by Human Resources and Skills Development Canada (HRSDC). This amount corresponds to the cost of a specific basket of goods and services representing a modest, basic standard of living in each of the 49 MBM geographic regions.

1 To convert to other family sizes, multiply the amount for persons not in economic families by the square root of the desired family size.

Source: Statistics Canada, Income Statistics Division.

Refers to all dividends, interest and other investment income, excluding capital gains or losses, received in

2010.

Refers to interest received during calendar year 2010 from deposits in banks, trust companies, cooperatives,

credit unions, caisses populaires, etc., as well as interest on savings certificates, bonds and debentures, and all dividends from both Canadian and foreign corporate stocks and mutual funds. Also included is other investment income from either Canadian or foreign sources, such as net rents from real estate, mortgage and loan interest received, regular income from an estate or trust fund, and interest from insurance policies. Does not include capital gains or losses.

Reported in: 2011

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Questions 54 and 55(i)

Responses: Positive or negative dollar value or nil

Remarks: While it should be included conceptually, it was not always possible to measure the income earned within a registered Tax-free Savings Account (TFSA). Refer to the Income Reference Guide, National Household Survey, for more details.

See also 'Remarks' under Total income.

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Questions 54 and 55(i)

Responses: Positive or negative dollar value or nil

Remarks: While it should be included conceptually, it was not always possible to measure the income earned within a registered Tax-free Savings Account (TFSA). Refer to the Income Reference Guide, National Household Survey, for more details.

See also 'Remarks' under Total income.

Refers to a person aged 15 years and over, who received wages and salaries, net income from a non-farm

unincorporated business and/or professional practice, and/or net farm self-employment income during calendar year 2010.

Refers to total income received by persons aged 15 years and over during calendar year 2010 as wages and

salaries, net income from a non-farm unincorporated business and/or professional practice, and/or net farm

self-employment income.

Reported in: 2011

Reported for: Population aged 15 years and over in private households

Question no.: Derived variable: Questions 54 and 55(a), (b) and (c)

Responses: Positive or negative dollar value or nil

Remarks: See 'Remarks' under Total income.

See also the detailed definitions for each of the components.

Reported for: Population aged 15 years and over in private households

Question no.: Derived variable: Questions 54 and 55(a), (b) and (c)

Responses: Positive or negative dollar value or nil

Remarks: See 'Remarks' under Total income.

See also the detailed definitions for each of the components.

The economic family total income is the sum of the total incomes of all members of that family.

Reported in: 2011

Reported for: Economic families in private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income, see 'Remarks' under Total income.

See also Economic family.

Reported for: Economic families in private households

Question no.: Derived variable: Questions 54 and 55

Responses: Positive or negative dollar value or nil

Remarks: For details on the components of total income, see 'Remarks' under Total income.

See also Economic family.

Refers to all cash benefits received from federal, provincial, territorial or municipal governments during 2010.

Refers to total income from all transfer payments received from federal, provincial, territorial or municipal

governments during calendar year 2010. This variable is derived by summing the amounts reported in:

- he Old Age Security pension and Guaranteed Income Supplement, Allowance and Allowance for the Survivor

- benefits from Canada Pension Plan or Quebec Pension Plan

- benefits from employment Insurance

- child benefits

- other income from government sources.

Reported in: 2011

Reported for: Population aged 15 years and over in private households

Question no.: Derived variable based upon responses to Questions 54 and 55(d), (e), (f), (g) and (h)

Responses: Dollar value or nil

Remarks: See the detailed definitions and 'Remarks' for each of the components.

Reported for: Population aged 15 years and over in private households

Question no.: Derived variable based upon responses to Questions 54 and 55(d), (e), (f), (g) and (h)

Responses: Dollar value or nil

Remarks: See the detailed definitions and 'Remarks' for each of the components.

The total income of a household is the sum of the total incomes of all members of that household.

The population in private households is sorted according to its adjusted after-tax family income and then divided into 10 equal groups each containing 10% of the population.

The income decile group provides a rough ranking of the economic situation of a person based on his or her

relative position in the economic families adjusted after-tax income distribution. The population in private

households is sorted according to its adjusted after-tax family income and then divided into 10 equal groups

each containing 10% of the population.

Reported in: 2011

Reported for: Population in private households

Question no.: Variable dérivée

Responses: In the lowest decile

In the second decile

In the third decile

In the fourth decile

In the fifth decile

In the sixth decile

In the seventh decile

In the eighth decile

In the ninth decile

In the highest decile

Remarks: Refer to Adjusted after-tax income for economic families and persons not in economic families.

Reported for: Population in private households

Question no.: Variable dérivée

Responses: In the lowest decile

In the second decile

In the third decile

In the fourth decile

In the fifth decile

In the sixth decile

In the seventh decile

In the eighth decile

In the ninth decile

In the highest decile

Remarks: Refer to Adjusted after-tax income for economic families and persons not in economic families.

Refers to the position of a person, economic family, person not in an economic family aged 15 years or over, or household in relation to one of the low income lines.

The income status can be defined in several ways.

Refers to the position of a person, economic family, person not in an economic family aged 15 years or over, or household in relation to one of the low income lines.

In the National Household Survey, definitions were created for six different lines. Five lines were defined by Statistics Canada:

Refers to the position of a person, economic family, person not in an economic family aged 15 years or over, or household in relation to one of the low income lines.

In the National Household Survey, definitions were created for six different lines. Five lines were defined by Statistics Canada:

- low-income measure based on after-tax income (LIM-AT)

- low-income measure based on before-tax income (LIM-BT)

- low-income measure based on market income (LIM-MI)

- low-income cut-off based on after-tax income (LICO-AT)

- low-income cut-off based on before-tax income (LICO-BT).

- HRSDC's Market Basket Measure (MBM).

Reported in: 2011

Reported for: Population in private households and, depending on the definition used, economic families and persons not in economic families aged 15 years and over in private households or, private households.

Question no.: Derived variable

Responses: Below the line - In low income;

At or above the line - Other;

Not applicable.

Remarks: Four dimensions generally distinguish the low-income lines:

Full details are explained in each definition:

Members of an economic family all share the same income status for LICO-AT and LICO-BT.

The low income concept does not apply to the full population in private households. For the purposes of low income statistics, units in the Yukon Territory, Northwest Territories and Nunavut and on Indian reserves were excluded (see Area of residence - On reserve for the full criteria).

The low income after-tax cut-offs were based on certain expenditure–income patterns which are not available from survey data for the entire population.

It is also felt that in certain areas, the consumption of hunting or fishing products, barter economies or substantial in-kind transfers may reduce the interpretability of income-based measures.

See also Prevalence of low income, Low-income gap and Severity of low income.

Refer to the data quality notes in the Income Reference Guide, National Household Survey, 2011.

Tables 3.1 Summary of low-income lines in the 2011 National Household Survey

Source: Statistics Canada, Income Statistics Division.

Reported for: Population in private households and, depending on the definition used, economic families and persons not in economic families aged 15 years and over in private households or, private households.

Question no.: Derived variable

Responses: Below the line - In low income;

At or above the line - Other;

Not applicable.

Remarks: Four dimensions generally distinguish the low-income lines:

- any geographical variations

- aggregation or unit of analysis

- the income variable to test

- equivalence scale for units of different sizes

Full details are explained in each definition:

- Low-income measure after-tax (LIM-AT)

- Low-income measure before-tax (LIM-BT)

- Low-income measure of market income (LIM-MI)

- Low-income after-tax cut-off (LICO-AT)

- Low-income before-tax cut-off (LICO-BT)

- HRSDC's Market Basket Measure (MBM).

Members of an economic family all share the same income status for LICO-AT and LICO-BT.

The low income concept does not apply to the full population in private households. For the purposes of low income statistics, units in the Yukon Territory, Northwest Territories and Nunavut and on Indian reserves were excluded (see Area of residence - On reserve for the full criteria).

The low income after-tax cut-offs were based on certain expenditure–income patterns which are not available from survey data for the entire population.

It is also felt that in certain areas, the consumption of hunting or fishing products, barter economies or substantial in-kind transfers may reduce the interpretability of income-based measures.

See also Prevalence of low income, Low-income gap and Severity of low income.

Refer to the data quality notes in the Income Reference Guide, National Household Survey, 2011.

Tables 3.1 Summary of low-income lines in the 2011 National Household Survey

| Dimensions | Low-income concept | ||

| Low Income Measures (LIM) | Low-income cut-offs (LICO) | Market Basket Measure (MBM) | |

| Geography | One level across Canada | Size of area of residence | 49 regions |

| Unit for income | Households | Economic families and persons 15+ not in EF | Economic families and persons 15+ not in EF |

| Adjustment factor | Square root of household size | Different lines based on size of economic family up to 7+ members category | Square root of economic family size |

| Income | After-tax income of households1 | After-tax income of economic families4 | Disposable income for MBM for economic families and persons not in economic families6 |

| Household total income2 | |||

| Market income of households3 | Economic family total income5 | ||

| Line | Half the median of adjusted income | Income level at which families usually spend 20 percentage points more than the average family on shelter, food and clothing7 | Price of the basket of goods and services for the reference family8 |

| Notes: | |||

| 1For the Low-income measure after-tax (LIM-AT). | |||

| 2For the Low-income measure before-tax (LIM-BT). | |||

| 3For the Low-income measure of market income (LIM-MI). | |||

| 4For the Low-income after-tax cut-offs (LICO-AT). | |||

| 5For the Low-income before-tax cut-offs (LICO-BT). | |||

| 6For HRSDC's Market Basket Measure (MBM). | |||

| 7Based on estimates from the 1992 Family Expenditure Survey adjusted to 2010 dollars with the Consumer Price Index (CPI). | |||

| 8The contents of the basket were defined by Human Ressources and Skills Development Canada, prices were measured by Statistics Canada. | |||

Refers to all federal, provincial and territorial taxes paid on 2010 income.

Refers to all federal, provincial and territorial taxes paid on 2010 income. Federal, provincial and territorial taxes paid refer to taxes on income, after taking into account exemptions, deductions, non-refundable tax credits and the Quebec abatement. These taxes are obtained from the income tax files for persons who allowed access to their income tax data and from direct responses on the questionnaire for others.

Reported in: 2011

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Questions 54 and 55

Responses: Dollar value or nil

Remarks: Income tax paid on 2010 income includes amounts that may not be paid until 2011 or later. Taxes paid in 2010 on income from 2009 or earlier are excluded.

Contributions to Employment Insurance and to Canada Pension Plan (or Quebec Pension Plan), both federal programs, are not included in income taxes, nor are they deducted from income to arrive at after-tax income.

Some of the income tax included may be liable for taxable amounts not considered income in our standard statistical definitions such as capital gains or Registered Retirement Savings Plan (RRSP) withdrawals.

Reported for: Population aged 15 years and over in private households

Question no.: Direct variable: Questions 54 and 55

Responses: Dollar value or nil

Remarks: Income tax paid on 2010 income includes amounts that may not be paid until 2011 or later. Taxes paid in 2010 on income from 2009 or earlier are excluded.

Contributions to Employment Insurance and to Canada Pension Plan (or Quebec Pension Plan), both federal programs, are not included in income taxes, nor are they deducted from income to arrive at after-tax income.

Some of the income tax included may be liable for taxable amounts not considered income in our standard statistical definitions such as capital gains or Registered Retirement Savings Plan (RRSP) withdrawals.

The low-income gap measures how many dollars are required to bring a low-income unit up to the low-income line.

The low-income gap measures by how many dollars an income falls below a low-income line. The variable is zero for income at or above the line. The maximum value for this field is the applicable low-income line.

The low-income gap ratio is an alternate measure that expresses the low-income gap as a fraction of the low-income line. This statistic is zero if the income is at or above the line and is one if the income is zero or negative.

The low-income gap ratio is an alternate measure that expresses the low-income gap as a fraction of the low-income line. This statistic is zero if the income is at or above the line and is one if the income is zero or negative.

Reported in: 2011

Reported for: Population in private households and, depending on the definition used, economic families and persons not in economic families aged 15 years and over in private households or, private households.

Question no.: Not applicable

Responses: Not applicable

Remarks: The gap and gap ratio are calculated for each of the six low-income lines available on the NHS. These variables are appropriate for distributions and some statistics.

See also Income status and related low-income line definitions.

Reported for: Population in private households and, depending on the definition used, economic families and persons not in economic families aged 15 years and over in private households or, private households.

Question no.: Not applicable

Responses: Not applicable

Remarks: The gap and gap ratio are calculated for each of the six low-income lines available on the NHS. These variables are appropriate for distributions and some statistics.

See also Income status and related low-income line definitions.

Income levels at which families or persons not in economic families spend 20 percentage points more than average of their after-tax income on food, shelter and clothing.

Measures of low income known as low income cut-offs (LICOs) were first introduced in Canada in 1968 based on 1961 Census income data and 1959 family expenditure patterns. At that time, expenditure patterns indicated that Canadian families spent about 50% of their total income on food, shelter and clothing. It was arbitrarily estimated that families spending 70% or more of their income (20 percentage points more than the average) on these basic necessities would be in 'straitened' circumstances. With this assumption, low income cut-off points were set for six different sizes of families and persons aged 15 years and over, not in economic families.

Subsequent to these initial cut-offs, revised low income cut-offs were established based on national family expenditure data from 1969, 1978, 1986 and 1992. Cut-offs for other years are indexed by applying the corresponding Consumer Price Index (CPI) inflation rate to the cut-offs from the base year. For the NHS, the 1992 base year was used to construct the cut-offs.

The initial LICOs were based upon the total income before tax of families and persons aged 15 years and over, not in economic families.

After a comprehensive review of low income cut-offs completed in 1991, low income cut-offs based upon after-tax income were published for the first time in Income After Tax, Distributions by Size in Canada, 1990 (Catalogue no. 13-210).

In a similar fashion to the derivation of low income cut-offs based upon total income before tax, cut-offs are estimated independently for economic families and persons not in economic families based upon family expenditure and income after tax. Consequently the low income after-tax cut-offs are set at after-tax income levels, differentiated by size of family and area of residence, where families spend 20 percentage points more of their after-tax income than the average family on food, shelter and clothing. Based on the 1992 Family Expenditure Survey, families spent 43%, on average, of their after-tax income on necessities. The threshold was thus set to the income level where families spent 63% of their after-tax income on necessities.

The following is the 2010 matrix of low income after-tax cut-offs:

Table 3.3 Low income after-tax cut-offs (LICO-AT at 1992 base) for economic families and persons not in economic families, 2010

Subsequent to these initial cut-offs, revised low income cut-offs were established based on national family expenditure data from 1969, 1978, 1986 and 1992. Cut-offs for other years are indexed by applying the corresponding Consumer Price Index (CPI) inflation rate to the cut-offs from the base year. For the NHS, the 1992 base year was used to construct the cut-offs.

The initial LICOs were based upon the total income before tax of families and persons aged 15 years and over, not in economic families.

After a comprehensive review of low income cut-offs completed in 1991, low income cut-offs based upon after-tax income were published for the first time in Income After Tax, Distributions by Size in Canada, 1990 (Catalogue no. 13-210).

In a similar fashion to the derivation of low income cut-offs based upon total income before tax, cut-offs are estimated independently for economic families and persons not in economic families based upon family expenditure and income after tax. Consequently the low income after-tax cut-offs are set at after-tax income levels, differentiated by size of family and area of residence, where families spend 20 percentage points more of their after-tax income than the average family on food, shelter and clothing. Based on the 1992 Family Expenditure Survey, families spent 43%, on average, of their after-tax income on necessities. The threshold was thus set to the income level where families spent 63% of their after-tax income on necessities.

The following is the 2010 matrix of low income after-tax cut-offs:

Table 3.3 Low income after-tax cut-offs (LICO-AT at 1992 base) for economic families and persons not in economic families, 2010

Reported in: 2011

Reported for: Economic families and persons aged 15 years and over not in economic families in private households

Question no.: Not applicable

Responses: Not applicable

Remarks: Low-income cut-off is one of a series of low-income lines used in the National Household Survey. See also Income status; Prevalence of low income; Low-income gap; Severity of low income and After-tax income of economic families.

The choice of using before- or after-tax income cut-offs depends upon the analysis undertaken. The after-tax income cut-offs will take into account the reduced spending power of families because of income taxes paid.

Since their initial publication, Statistics Canada has clearly and consistently emphasized that the LICOs are not measures of poverty. Rather, LICOs reflect a consistent and well-defined methodology that identifies those who are substantially worse off than average. These measures have enabled Statistics Canada to report important trends, such as the changing composition of those below the LICOs over time.

Table 3.3 Low income after-tax cut-offs (1992 base) for economic families and persons not in economic families, 2010

Source: Income Research Paper Series, Low-Income Lines 2010-2011, Statistics Canada Catalogue no. 75F0002MIE, 2012 no. 002.

Reported for: Economic families and persons aged 15 years and over not in economic families in private households

Question no.: Not applicable

Responses: Not applicable

Remarks: Low-income cut-off is one of a series of low-income lines used in the National Household Survey. See also Income status; Prevalence of low income; Low-income gap; Severity of low income and After-tax income of economic families.

The choice of using before- or after-tax income cut-offs depends upon the analysis undertaken. The after-tax income cut-offs will take into account the reduced spending power of families because of income taxes paid.

Since their initial publication, Statistics Canada has clearly and consistently emphasized that the LICOs are not measures of poverty. Rather, LICOs reflect a consistent and well-defined methodology that identifies those who are substantially worse off than average. These measures have enabled Statistics Canada to report important trends, such as the changing composition of those below the LICOs over time.

Table 3.3 Low income after-tax cut-offs (1992 base) for economic families and persons not in economic families, 2010

Size of area of residence | |||||

| Economic family size | Rural area | Small population centres with less than 30,000 persons | Medium population centres with a population between 30,000 and 99,999 persons | Large urban population centres | |

| Population between 100,000 and 499,999 | Population 500,000 persons or more | ||||

| Person not in an economic family | 12,271 | 14,044 | 15,666 | 15,865 | 18,759 |

| 2 persons | 14,936 | 17,094 | 19,069 | 19,308 | 22,831 |

| 3 persons | 18,598 | 21,283 | 23,744 | 24,043 | 28,430 |

| 4 persons | 23,202 | 26,554 | 29,623 | 29,996 | 35,469 |

| 5 persons | 26,421 | 30,237 | 33,732 | 34,157 | 40,388 |

| 6 persons | 29,301 | 33,534 | 37,410 | 37,881 | 44,791 |

| 7 or more persons | 32,182 | 36,831 | 41,087 | 41,604 | 49,195 |

Source: Income Research Paper Series, Low-Income Lines 2010-2011, Statistics Canada Catalogue no. 75F0002MIE, 2012 no. 002.

Income levels at which families or persons not in economic families spend 20 percentage points more than average of their before tax income on food, shelter and clothing.

Measures of low income known as low income (before tax) cut-offs (LICO-BT) were first introduced in Canada in 1968 based on 1961 Census income data and 1959 family expenditure patterns. At that time, expenditure patterns indicated that Canadian families spent about 50% of their total income on food, shelter and clothing. It was arbitrarily estimated that families spending 70% or more of their income (20 percentage points more than the average) on these basic necessities would be in 'straitened' circumstances. With this assumption, low income cut-off points were set for six different sizes of families and persons aged 15 years and over not in economic families.

Subsequent to these initial cut-offs, revised low income before tax cut-offs were established based on national family expenditure data from 1969, 1978, 1986 and 1992. Cut-offs for other years are indexed by applying the corresponding Consumer Price Index (CPI) inflation rate to the cut-offs from the base year. For the NHS, the 1992 base year was used to construct the cut-offs.

The initial LICOs were based upon the total income before tax of families and persons aged 15 years and over, not in economic families.

After a comprehensive review of low income cut-offs completed in 1991, low income cut-offs based upon after-tax income were published for the first time in Income After Tax, Distributions by Size in Canada, 1990 (Catalogue no. 13-210).

In a similar fashion to the derivation of low income cut-offs based upon total income before tax, cut-offs are estimated independently for economic families and persons not in economic families based upon family expenditure and income after tax. Consequently the low income after-tax cut-offs are set at after-tax income levels, differentiated by size of family and area of residence, where families spend 20 percentage points more of their after-tax income than the average family on food, shelter and clothing. Based on the 1992 Family Expenditure Survey, families spent 50%, on average, of their total income on necessities. The threshold was thus set to the income level where families spent 70% of their income on necessities.

The following is the 2010 matrix of low income before-tax cut-offs (LICO-BT):

Table 3.4 Low income before tax cut-offs (LICO-BT at 1992 base) for economic families and persons not in economic families, 2010

Subsequent to these initial cut-offs, revised low income before tax cut-offs were established based on national family expenditure data from 1969, 1978, 1986 and 1992. Cut-offs for other years are indexed by applying the corresponding Consumer Price Index (CPI) inflation rate to the cut-offs from the base year. For the NHS, the 1992 base year was used to construct the cut-offs.

The initial LICOs were based upon the total income before tax of families and persons aged 15 years and over, not in economic families.

After a comprehensive review of low income cut-offs completed in 1991, low income cut-offs based upon after-tax income were published for the first time in Income After Tax, Distributions by Size in Canada, 1990 (Catalogue no. 13-210).

In a similar fashion to the derivation of low income cut-offs based upon total income before tax, cut-offs are estimated independently for economic families and persons not in economic families based upon family expenditure and income after tax. Consequently the low income after-tax cut-offs are set at after-tax income levels, differentiated by size of family and area of residence, where families spend 20 percentage points more of their after-tax income than the average family on food, shelter and clothing. Based on the 1992 Family Expenditure Survey, families spent 50%, on average, of their total income on necessities. The threshold was thus set to the income level where families spent 70% of their income on necessities.

The following is the 2010 matrix of low income before-tax cut-offs (LICO-BT):

Table 3.4 Low income before tax cut-offs (LICO-BT at 1992 base) for economic families and persons not in economic families, 2010

Reported in: 2011

Reported for: Economic families and persons aged 15 years and over not in economic families in private households

Question no.: Not applicable

Responses: Not applicable

Remarks: Low-income cut-off is one of a series of low-income lines used in the National Household Survey. See also Income status; Prevalence of low income; Low income gap; Severity of low income and Economic family total income.

Since their initial publication, Statistics Canada has clearly and consistently emphasized that the LICOs are not measures of poverty. Rather, LICOs reflect a consistent and well-defined methodology that identifies those who are substantially worse off than average. These measures have enabled Statistics Canada to report important trends, such as the changing composition of those below the LICOs over time.

The choice of using before or after-tax income cut-offs depends upon the analysis undertaken. The after-tax income cut-offs will take into account the reduced spending power of families because of income taxes paid.

Table 3.4 Low income before tax cut-offs (1992 base) for economic families and persons not in economic families, 2010

Source: Income Research Paper Series, Low-Income Lines 2010-2011, Statistics Canada Catalogue no. 75F0002MIE, 2012 no. 002.

Reported for: Economic families and persons aged 15 years and over not in economic families in private households

Question no.: Not applicable

Responses: Not applicable

Remarks: Low-income cut-off is one of a series of low-income lines used in the National Household Survey. See also Income status; Prevalence of low income; Low income gap; Severity of low income and Economic family total income.

Since their initial publication, Statistics Canada has clearly and consistently emphasized that the LICOs are not measures of poverty. Rather, LICOs reflect a consistent and well-defined methodology that identifies those who are substantially worse off than average. These measures have enabled Statistics Canada to report important trends, such as the changing composition of those below the LICOs over time.

The choice of using before or after-tax income cut-offs depends upon the analysis undertaken. The after-tax income cut-offs will take into account the reduced spending power of families because of income taxes paid.

Table 3.4 Low income before tax cut-offs (1992 base) for economic families and persons not in economic families, 2010

Size of area of residence | |||||

| Economic family size | Rural area | Small population centres with less than 30,000 persons | Medium population centres with a population between 30,000 and 99,999 persons | Large urban population centres | |

| Population between 100,000 and 499,999 | Population 500,000 persons or more | ||||

| Person not in an economic family | 15,583 | 17,729 | 19,375 | 19,496 | 22,637 |

| 2 persons | 19,400 | 22,070 | 24,120 | 24,269 | 28,182 |

| 3 persons | 23,849 | 27,132 | 29,652 | 29,836 | 34,646 |

| 4 persons | 28,957 | 32,943 | 36,003 | 36,226 | 42,065 |

| 5 persons | 32,842 | 37,363 | 40,833 | 41,086 | 47,710 |

| 6 persons | 37,041 | 42,140 | 46,054 | 46,339 | 53,808 |

| 7 or more persons | 41,240 | 46,916 | 51,274 | 51,591 | 59,907 |

Source: Income Research Paper Series, Low-Income Lines 2010-2011, Statistics Canada Catalogue no. 75F0002MIE, 2012 no. 002.

The Low-income measure after tax (LIM-AT) is a fixed percentage (50%) of median adjusted after-tax income of households observed at the person level, where 'adjusted' indicates that a household's needs are taken into account.

In simple terms, the Low-income measure after tax (LIM-AT) is a fixed percentage (50%) of median adjusted after-tax income of households observed at the person level, where 'adjusted' indicates that a household's needs are taken into account. Adjustment for household sizes reflects the fact that a household's needs increase as the number of members increase, although not necessarily by the same proportion per additional member.

The LIMs derivation begins by calculating the 'adjusted household income' for each household by dividing household income by the square root of the number of persons in the household, otherwise known as the 'equivalence scale.' This adjusted household income is assigned to each individual in the private household, and the median of the adjusted household income (where half of all individuals will be above it and half below) is determined over the population. The LIM for a household of one person is 50% of this median, and the LIMs for other sizes of households are equal to this value multiplied by their equivalence scale.

Unlike other low in lines, LIMs do not vary by size of area of residence.

Thresholds for specific household sizes are presented in Table 3.2 Low-income measures thresholds (LIM-AT, LIM-BT and LIM-MI) for households of Canada, 2010.

The LIMs derivation begins by calculating the 'adjusted household income' for each household by dividing household income by the square root of the number of persons in the household, otherwise known as the 'equivalence scale.' This adjusted household income is assigned to each individual in the private household, and the median of the adjusted household income (where half of all individuals will be above it and half below) is determined over the population. The LIM for a household of one person is 50% of this median, and the LIMs for other sizes of households are equal to this value multiplied by their equivalence scale.

Unlike other low in lines, LIMs do not vary by size of area of residence.

Thresholds for specific household sizes are presented in Table 3.2 Low-income measures thresholds (LIM-AT, LIM-BT and LIM-MI) for households of Canada, 2010.

Reported in: 2011

Reported for: Private households

Question no.: Derived variable

Responses: Not applicable

Remarks: Low-income measure after tax (LIM-AT) is one of a series of low-income lines used in the National Household Survey. See also Income status; Prevalence of low income; Low-income gap; Severity of low income and Adjusted after-tax income of households.

Following the practice of many international organizations, Statistics Canada began to publish before- and after-tax low income measures (LIMs) in 1991. The LIM is intended as a reference for international comparisons.

After a comprehensive research of low income measures completed in 2008-2009, changes relating to the (1) accounting unit utilized, (2) unit of analysis and (3) equivalence scale were made.

(1) The household replaced the economic family as the accounting unit in which individuals pooled income to enjoy economies of scale. A household refers to a person or group of persons residing in a dwelling.

(2) The median began to be calculated over the population individuals, as opposed to over that of families or households. Resultantly, each person in the population is represented by its adjusted household income.

(3) In order to ensure international consistency, the equivalence scale was changed and adjusted household income was calculated by dividing household income by the square root of the number of members in the household.

The choice of using before- or after-tax low income measures depends upon the analysis undertaken. The after-tax low income measures will take into account the reduced spending power of households because of income taxes paid.

Since their initial publication, Statistics Canada has clearly and consistently emphasized that low income lines are not measures of poverty. Rather, low income lines reflect a consistent and well-defined methodology that identifies those who are substantially worse off than average. These measures have enabled Statistics Canada to report important trends, such as the changing composition of those below the low income lines over time.

For information on various low income concepts and adjusted household income see also 'Low income lines', Income Research Paper Series (Catalogue no.75F0002M, 2012 -No.-002)

Table 3.2 Low-income measures thresholds (LIM-AT, LIM-BT and LIM-MI) for households of Canada, 2010

Source: Statistics Canada, National Household Survey, 2011.

Reported for: Private households

Question no.: Derived variable

Responses: Not applicable

Remarks: Low-income measure after tax (LIM-AT) is one of a series of low-income lines used in the National Household Survey. See also Income status; Prevalence of low income; Low-income gap; Severity of low income and Adjusted after-tax income of households.

Following the practice of many international organizations, Statistics Canada began to publish before- and after-tax low income measures (LIMs) in 1991. The LIM is intended as a reference for international comparisons.

After a comprehensive research of low income measures completed in 2008-2009, changes relating to the (1) accounting unit utilized, (2) unit of analysis and (3) equivalence scale were made.

(1) The household replaced the economic family as the accounting unit in which individuals pooled income to enjoy economies of scale. A household refers to a person or group of persons residing in a dwelling.

(2) The median began to be calculated over the population individuals, as opposed to over that of families or households. Resultantly, each person in the population is represented by its adjusted household income.

(3) In order to ensure international consistency, the equivalence scale was changed and adjusted household income was calculated by dividing household income by the square root of the number of members in the household.

The choice of using before- or after-tax low income measures depends upon the analysis undertaken. The after-tax low income measures will take into account the reduced spending power of households because of income taxes paid.

Since their initial publication, Statistics Canada has clearly and consistently emphasized that low income lines are not measures of poverty. Rather, low income lines reflect a consistent and well-defined methodology that identifies those who are substantially worse off than average. These measures have enabled Statistics Canada to report important trends, such as the changing composition of those below the low income lines over time.

For information on various low income concepts and adjusted household income see also 'Low income lines', Income Research Paper Series (Catalogue no.75F0002M, 2012 -No.-002)

Table 3.2 Low-income measures thresholds (LIM-AT, LIM-BT and LIM-MI) for households of Canada, 2010

| Household size1 | After-tax income | Before-tax income | Market income |

| 1 person | 19,460 | 22,160 | 19,283 |

| 2 persons | 27,521 | 31,339 | 27,270 |

| 3 persons | 33,706 | 38,382 | 33,399 |

| 4 persons | 38,920 | 44,320 | 38,566 |

| 5 persons | 43,514 | 49,551 | 43,118 |

| 6 persons | 47,667 | 54,281 | 47,234 |

| 7 persons | 51,486 | 58,630 | 51,018 |

| 1To convert to other household sizes, multiply the value in the one-person household by the square root of the desiredhousehold size. | |||

Source: Statistics Canada, National Household Survey, 2011.

The Low-income measure before tax (LIM-BT) is a fixed percentage (50%) of median adjusted total income of households observed at the person level, where 'adjusted' indicates that a household's needs are taken into account.

In simple terms, the Low-income measure before tax (LIM-BT) is a fixed percentage (50%) of median adjusted total income of households observed at the person level, where 'adjusted' indicates that a household's needs are taken into account. Adjustment for household sizes reflects the fact that a household's needs increase as the number of members increase, although not necessarily by the same proportion per additional member.

The LIMs derivation begins by calculating the 'adjusted household income' for each household by dividing household income by the square root of the number of persons in the household, otherwise known as the 'equivalence scale.' This adjusted household income is assigned for each individual in the private household, and the median of the adjusted household income (where half of all individuals will be above it and half below) is determined over the population. The LIM for a household of one person is 50% of this median, and the LIMs for other sizes of households are equal to this value multiplied by their equivalence scale.

Unlike other low income lines, LIMs do not vary by size of area of residence.

Thresholds for specific household sizes are presented in Table 3.2 Low-income measures thresholds (LIM-AT, LIM-BT and LIM-MI) for households of Canada, 2010.

The LIMs derivation begins by calculating the 'adjusted household income' for each household by dividing household income by the square root of the number of persons in the household, otherwise known as the 'equivalence scale.' This adjusted household income is assigned for each individual in the private household, and the median of the adjusted household income (where half of all individuals will be above it and half below) is determined over the population. The LIM for a household of one person is 50% of this median, and the LIMs for other sizes of households are equal to this value multiplied by their equivalence scale.

Unlike other low income lines, LIMs do not vary by size of area of residence.

Thresholds for specific household sizes are presented in Table 3.2 Low-income measures thresholds (LIM-AT, LIM-BT and LIM-MI) for households of Canada, 2010.

Reported in: 2011

Reported for: Private households

Question no.: Derived variable

Responses: Not applicable

Remarks: Low-income measure before tax (LIM-BT) is one of a series of low-income lines used in the National Household Survey. See lso Income status; Prevalence of low income; Low-income gap; Severity of low income and Adjusted total income of households.

Following the practice of many international organizations, Statistics Canada began to publish before- and after-tax low income measures (LIMs) in 1991. The LIM is intended as a reference for international comparisons.

After a comprehensive research of low income measures completed in 2008-2009, changes relating to the (1) accounting unit utilized, (2) unit of analysis and (3) equivalence scale were made.

(1) The household replaced the economic family as the accounting unit in which individuals pooled income to enjoy economies of scale. A household refers to a person or group of persons residing in a dwelling.

(2) The median began to be calculated over the population individuals, as opposed to over that of families or households. Resultantly, each person in the population is represented by its adjusted household income.

(3) In order to ensure international consistency, the equivalence scale was changed and adjusted household income was calculated by dividing household income by the square root of the number of members in the household.

The choice of using before- or after-tax low income measures depends upon the analysis undertaken. The after-tax low income measures will take into account the reduced spending power of households because of income taxes paid.

Since their initial publication, Statistics Canada has clearly and consistently emphasized that low income lines are not measures of poverty. Rather, low income lines reflect a consistent and well-defined methodology that identifies those who are substantially worse off than average. These measures have enabled Statistics Canada to report important trends, such as the changing composition of those below the low income lines over time.

For information on various low income concepts and adjusted household income see also 'Low income lines', Income Research Paper Series (Catalogue no. 75F0002M, 2012 - No. 002).

Reported for: Private households

Question no.: Derived variable

Responses: Not applicable

Remarks: Low-income measure before tax (LIM-BT) is one of a series of low-income lines used in the National Household Survey. See lso Income status; Prevalence of low income; Low-income gap; Severity of low income and Adjusted total income of households.

Following the practice of many international organizations, Statistics Canada began to publish before- and after-tax low income measures (LIMs) in 1991. The LIM is intended as a reference for international comparisons.

After a comprehensive research of low income measures completed in 2008-2009, changes relating to the (1) accounting unit utilized, (2) unit of analysis and (3) equivalence scale were made.

(1) The household replaced the economic family as the accounting unit in which individuals pooled income to enjoy economies of scale. A household refers to a person or group of persons residing in a dwelling.

(2) The median began to be calculated over the population individuals, as opposed to over that of families or households. Resultantly, each person in the population is represented by its adjusted household income.

(3) In order to ensure international consistency, the equivalence scale was changed and adjusted household income was calculated by dividing household income by the square root of the number of members in the household.

The choice of using before- or after-tax low income measures depends upon the analysis undertaken. The after-tax low income measures will take into account the reduced spending power of households because of income taxes paid.

Since their initial publication, Statistics Canada has clearly and consistently emphasized that low income lines are not measures of poverty. Rather, low income lines reflect a consistent and well-defined methodology that identifies those who are substantially worse off than average. These measures have enabled Statistics Canada to report important trends, such as the changing composition of those below the low income lines over time.

For information on various low income concepts and adjusted household income see also 'Low income lines', Income Research Paper Series (Catalogue no. 75F0002M, 2012 - No. 002).

The Low-income measure of market income (LIM-MI) is a fixed percentage (50%) of median adjusted market income of households observed at the person level, where 'adjusted' indicates that a household's needs are taken into account.

In simple terms, the Low-income measure of market income (LIM-MI) is a fixed percentage (50%) of median adjusted market income of households observed at the person level, where 'adjusted' indicates that a household's needs are taken into account. Adjustment for household sizes reflects the fact that a household’s needs increase as the number of members increase, although not necessarily by the same proportion per additional member.

The LIMs derivation begins by calculating the 'adjusted household income' for each household by dividing household income by the square root of the number of persons in the household, otherwise known as the 'equivalence scale.' This adjusted household income is assigned to each individual in the private household, and the median of the adjusted household income (where half of all individuals will be above it and half below) is determined over the population. The LIM for a household of one person is 50% of this median, and the LIMs for other sizes of households are equal to this value multiplied by their equivalence scale.

Unlike other low income lines, LIMs do not vary by size of area of residence.

Thresholds for specific household sizes are presented in Table 3.2 Low-income measures thresholds (LIM-AT, LIM-BT and LIM-MI) for households of Canada, 2010.

The LIMs derivation begins by calculating the 'adjusted household income' for each household by dividing household income by the square root of the number of persons in the household, otherwise known as the 'equivalence scale.' This adjusted household income is assigned to each individual in the private household, and the median of the adjusted household income (where half of all individuals will be above it and half below) is determined over the population. The LIM for a household of one person is 50% of this median, and the LIMs for other sizes of households are equal to this value multiplied by their equivalence scale.

Unlike other low income lines, LIMs do not vary by size of area of residence.

Thresholds for specific household sizes are presented in Table 3.2 Low-income measures thresholds (LIM-AT, LIM-BT and LIM-MI) for households of Canada, 2010.

Reported in: 2011

Reported for: Private households

Question no.: Not applicable

Responses: Not applicable

Remarks: Low-income measure of market income (LIM-MI) is one of a series of low-income lines used in the National Household Survey. See also Income status; Prevalence of low income; Low-income gap; Severity of low income and Adjusted after-tax income of households.

Following the practice of many international organizations, Statistics Canada began to publish before- and after-tax low income measures (LIMs) in 1991. The LIM is intended as a reference for international comparisons.

After a comprehensive research of low income measures completed in 2008-2009, changes relating to the (1) accounting unit utilized, (2) unit of analysis and (3) equivalence scale were made.

(1) The household replaced the economic family as the accounting unit in which individuals pooled income to enjoy economies of scale. A household refers to a person or group of persons residing in a dwelling.

(2) The median began to be calculated over the population individuals, as opposed to over that of families or households. Resultantly, each person in the population is represented by its adjusted household income.